Growth Model Design project | Porter.in

Context

Porter is in the business of providing on-demand, intracity goods transport for small and medium enterprises (SMEs). Through technology, Porter connects a highly fragmented largely SME customer base with a highly fragmented largely driver-cum-owner partner base.

Porter is present in 20 cities in India and 2 international countries (UAE, Bangladesh).

- Demand side user : Customers

- Supply side user : Driver Partners

We will focus on the demand side user i.e. the customer.

Core value proposition: For a tech savvy SME who needs a reliable yet affordable way to transport goods on demand, Porter is a goods transport agency that provides transparent, cost-effective goods transport pickup within 15 minutes.

Key elements of CVP | Porter | Major Competitor (Unorganized) |

Reliable | Vehicle is always available in-app due to thousands of driver partners in a given city | Each customer may only know 2-3 drivers who can bring goods vehicles. |

Affordable | 10-15% cheaper. Higher demand leads to higher vehicle utilization which leads to being able to offer lower price per trip since the per day earning will be higher because of higher number of trips. | Costly due to the need to pay for return trip also. There is limited set of drivers known leading to higher / willful pricing. |

Transparent | Vehicle category, price, ETA are clearly mentioned even before booking. There is automatic tracking through the app. | There is always negotiation on price. There is uncertainty on when vehicle will get free and come. There is manual tracking post pick up. |

Step 1: Decide your north star metric

Business model: Two sided marketplace

Maturity: Mature Scaling

North star: Revenue

Related metrics: LTV / CAC, TPC, AOV

Problem statement: Increase Porter's ARR from $500M to $1B in 12 months.

Step 2: Build the growth equation

Step 3: Collate current metrics

Market sizing

Sources

- Source 1: World Bank - India

- Source 2: "Logistics cost in India" report by National Council of Applied Economic Research (NCAER)

- Source 3: "Intracity Logistics Market in India" RedCore report, 2021

- 2022 GDP of India is USD 3420 Bn (Source 1).

- GDP growth is 8.2% (Source 1).

- 2023 GDP if India is USD 3700 Bn (Calculated from 1 and 2).

- Logistics is ~8.4% of GDP (Source 2) which translates to USD 309 Bn.

- Road logistics is 75% of the total logistics (Source 3) which translates to USD 232 Bn.

- Intracity road logistics is 14% of the road logistics (Source 3) which translates to USD 32 Bn.

TAM: Intracity road logistics of India = USD 32 Bn

- Top 50 cities intracity logistics is 50% of the intracity road logistics (Source 3) which translates to USD 16 Bn.

- On-demand intracity logistics is 60% of the Top 50 cities intracity road logistics (Source 3) which translates to USD 8 Bn.

SAM: On-demand intracity logistics of top 50 cities of India = USD 8 Bn

- Porter is the leading organized pan India intracity on-demand logistics service provider. It is realistic to aspire for 50% market share which translates to USD 4 Bn.

SOM: In the next 3-5 years, obtainable On-demand intracity logistics of top 50 cities of India = USD 4 Bn

Step 4: Establish the nuke scenario

Step 5: Calculate incremental growth

Step 6: Identify core levers and Present

Organic Acquisition

Acquisition through Referral

Initiative detail

What is the brag worthy value of the product?

- Vehicle is at the pick up location within 15 minutes of booking.

- Cost is 15% to 20% cheaper than the next best alternative.

- There is no negotiation with the driver on price or on service quality.

- Range of vehicles are available from two wheelers all the way to 17 feet trucks.

Getting vehicle with Porter is easy and fast. The best part is you do not have to negotiate".

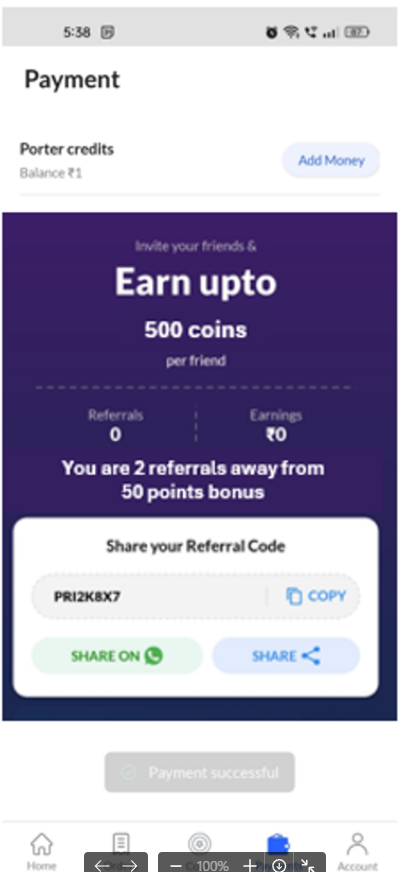

What will be the platform currency?

"Porter coins" is the platform currency. This is akin to money and can be used to pay for subsequent trips within 30 days from the date of credit.

A potential challenge with the current set up is that the coins can be used to redeem vouchers or transfer money into the bank. Ideally, the only way to use the coins should be on subsequent trips.

Who to ask for referral?

- Customers who have high NPS.

- Customers who have high TPC (bookings per month).

- Customers who have low complaints (TPO).

- Customers who use multiple categories of vehicles within Porter.

- Customers who have been with Porter for a longer period of time (Retention).

Happy flows

Booking Flow:

Invoice Flow:

How will customer discover referral program? How will they share?

Customer will discover the referral program through the below options.

Refer section in the account page.

Refer in-app and WhatsApp notification after a customer has experienced high rated orders.

After Porter credits recharge

- Tracking screen

Factors to consider while selecting the customers

- NPS (Promoter)

- TPC (More than 5 completed orders per month)

- TPO ( Less than 0.2 complaints per order per month)

- Tenure (has been using Porter for more than 3 month or 10 orders)

- Customers who have been with Porter for a longer period of time (Retention).

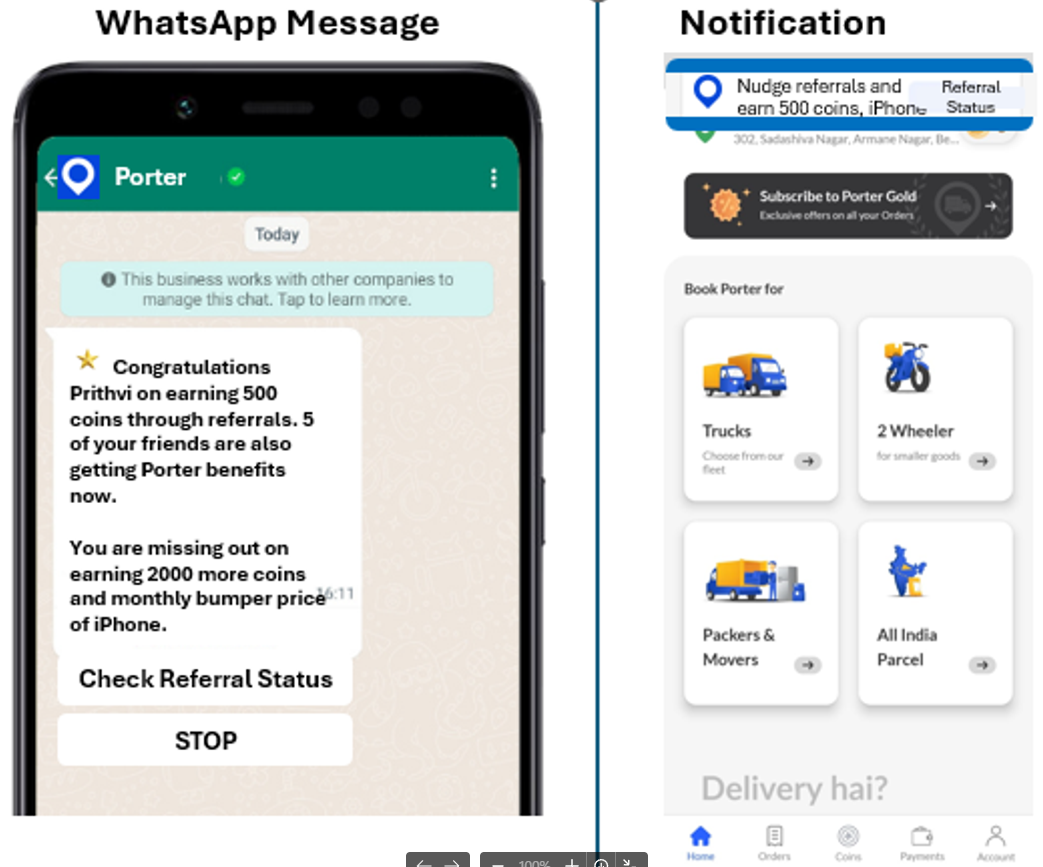

What will the referral communication say?

Predominantly, it will be a WhatsApp message

How will the referees track their referrals?

How will the referral invite look to a non-user?

How will you encourage referee to continue tracking?

Progressive rewards to incentivize movement towards the next milestone

Nudges on WhatsApp and Porter App from time to time, without spamming.

Leverage social aspect of showing CO2 emissions reduced due to not only the customer's trips but their referees' trips.Detailed flow including mockups for this are covered in the content loop section.

Experiment design

Hypothesis: If there is an option for customers to earn meaningful rewards by referring, then the acquisition through referral will increase by X%.

Success Metrics | Guardrails |

North star: Acquisitions | LTV / CAC ICP Retention of acquired customers Churn of existing customers Absolute burn amount |

Leading metrics: Views of refer page Clicks refer button Success metrics: Acquisition of new customers TPC of existing customers | |

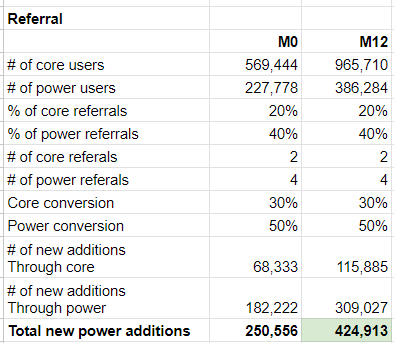

Modeling

Engagement and Retention

Initiative Deep Dive

Core value proposition

For a tech savvy SME who needs a reliable yet affordable way to transport goods on demand, Porter is a goods transport agency that provides transparent, cost-effective goods transport pickup within 15 minutes.

Key elements of CVP | Porter | Major Competitor (Unorganized) |

Reliable | Vehicle is always available in-app due to thousands of driver partners in a given city | Each customer may only know 2-3 drivers who can bring goods vehicles. |

Affordable | 10-15% cheaper. Higher demand leads to higher vehicle utilization which leads to being able to offer lower price per trip since the per day earning will be higher because of higher number of trips. | Costly due to the need to pay for return trip also. There is limited set of drivers known leading to higher / willful pricing. |

Transparent | Vehicle category, price, ETA are clearly mentioned even before booking. There is automatic tracking through the app. | There is always negotiation on price. There is uncertainty on when vehicle will get free and come. There is manual tracking post pick up. |

Reliable: "Vehicle is always available in-app"

Every time a customer enters pickup and drop, and tries to find a vehicle, they will see that a vehicle is available within a small ETA. Further, when they order, they will get the vehicle.

Affordable: "10-15% cheaper"

Every time a customer tries to book a trip, they will see that a vehicle is available with a price that is cheaper than what they will find with the major competitor (unorganized sector). Further, when the order is completed, they realize this value when they pay the lower amount.

Transparent: "Vehicle category, price, ETA are clearly mentioned even before booking. There is automatic tracking through the app."

Every time a customer tries to book a trip, they see ETA and price clearly. What they see is what they pay once order is complete. Once they book, they will see the vehicle in the tracking screen.

What is the natural frequency of your product?

User | Natural Frequency | Why? |

Casual | 2 orders a month | 1. May be using Porter as a secondary option (ICP 2). 2. May be a very small business with a natural limit (ICP 1). 3. May be using Porter in only very specific use cases (ICP 2). |

Core | 5 orders a week | 1. May be using Porter in specific use cases (ICP 1, 2) such as when sending goods to end-customer ,when plain vanilla service needed without loading unloading, 2. May be a small business with a natural limit (ICP 1). |

Power | 10 orders a week | 1. Uses Porter for majority of their logistics needs (70% plus wallet share) (ICP 1). |

Do you have other sub products?

There are other sub-products.

Other products | Use case | ICP |

On-demand 2w and Trucks | The service under consideration for this analysis Move goods from Point A to Point B within the city in the immediate present (next few min). | ICP1, ICP 2 |

All India Parcel | Move small items (<15 kg) primarily inter city (across cities) in the next 4-5 days. Not immediate. | ICP 1, ICP2, ICP 3 |

Packers & Movers | Shifting houses both within and between cities. | ICP 3 primarily |

What is their natural frequency like?

Products | Frequency | Why? |

On-demand 2w and Trucks | Covered in earlier section | Covered in earlier section |

All India Parcel | SME: 10 per month Retail: 1 per month | SMEs have more items to send. |

Packers & Movers | 1 per 3 years | People typically tend to shift houses only when major events happen such as a job change, marriage etc. |

What are the actions that make someone an active user for your product?

An active customer of Porter is any one who has done at-least one order per month.

An active user is NOT someone who has

- Only installed the app.

- Only entered pickup / drop location.

- Only checked the quote.

The reason why these are not considered active users is that they have not experienced the core value proposition (Reliable, Affordable, Transparent).

What is the natural frequency of your product?

User | Natural Frequency | Why? |

Casual | 1 order a week | 1. May be using Porter as a secondary option (ICP 2). 2. May be a very small business with a natural limit (ICP 1). 3. May be using Porter in only very specific use cases (ICP 2). |

Core | 5 orders a week | 1. May be using Porter in specific use cases (ICP 1, 2) such as when sending goods to end-customer, when plain vanilla service needed without loading unloading 2. May be a small business with a natural limit (ICP 1). |

Power | 10 orders a week | 1. Uses Porter for majority of their logistics needs (70% plus wallet share) (ICP 1). |

Customer segmentation: Power, Core, Casual deep-dive

Parameter | Power | Core | Casual |

Natural frequency Orders per week | 10 | 5 | 1 |

Most Value | Reliability, cost | Transparency, reliability | Reliability |

Key features | Repeat booking, Lowest price, Loyalty program | Near real time allocation, visibility of ETA and Cost | Near real time allocation, Invoices |

Use case | Primary source | Has known person in market Alternates based on other factors such as end consumer, availability | Secondary option Peak management |

Industry | Furniture, Textiles, Retail, Wholesale | Chemicals, Cement | Any |

Age | 20 - 40 years | 30 - 50 years | 20 - 50 years |

Gender | Male | Male | Male |

Location | Market area | Market area | Market area |

Turnover | < 25 crore | 25 to 250 crore | 25 to 250 crore |

Apps | WhatsApp, Facebook, Khatabook, PhonePe, Excel, Maps | WhatsApp, Facebook, Tally, Excel, Maps | WhatsApp, Facebook, Tally, Excel, Maps |

Decision maker vs operator | Same | Mix of same and different | Largely different |

Willing to spend | For 3w, 400 per trip | For 3w, 450 per trip | For 3w, 450 per trip |

Intervention 1: Casual to Core | Streaks

Parameter | Description |

Goal | Move Casual users to Core users Casual users are yet to fully appreciate the value proposition. The free order at the end of 5 orders incentivizes them to experience Porter more and fully appreciate the value proposition. |

Success metric | Success: Number of customers moving up from casual to core. Number of free orders. % of customers streaking. Leading: Number of customers placing orders everyday. Guardrail: ROI of the free order. Retention of the customers elevated to core through this. |

Problem statement | There are casual users who are not yet sold on the value proposition but use Porter once in a while. |

Current alternative | The users primarily use their local contact (unorganized sector). |

Solution | For every order > 1 per week, if at least 1 order is placed every day, make the 5th order free. |

Metrics to track | Success: Number of customers moving up from casual to core. Number of free orders. % of customers streaking. Leading: Number of customers placing orders everyday. Guardrail: ROI of the free order. Retention of the customers elevated to core through this. |

Ramp up milestones | 1. Build the streaks logic. 2. Publicize among the customer base. 3. Validate the hypothesis quantitatively and qualitatively. 4. Tune the numbers. 5. Scale up city by city. |

Customer experience on the app

Campaigns to convert Casual to Core (three more campaigns)

Parameters | Campaign 5: Discount Streak |

Segmentation | Casual customer |

Goal | Casual-> Core by pushing core customers to order more by giving discount streaks. |

Pitch / content | Get free order! Continue ordering every day and get 5th order free! |

Offer | For every order > 1 per week, if at least 1 order is placed every day, make the 5th order free. |

Channel | Push notification, WhatsApp |

Frequency | Once a week |

Timing | Log-in after completing 1 orders |

Success metrics | Success: Number of customers moving up from casual to core. Number of free orders. % of customers streaking. Leading: Number of customers placing orders everyday. Guardrail: ROI of the free order. Retention of the customers elevated to core through this. |

Intervention 2: Core to Power | Subscription

Parameter | Description |

Goal | Move Core users to Power users Core users are already largely sold on the value proposition. This gives them a nudge to move most of their orders to Porter. |

Success metric | Success: Number of customers moving up from core to power. Leading: CTR of the subscription screen. Funnel of subscription landing page to purchase. Number of orders placed by customer. Guardrail: ROI of the discount offered through the subscription. Number of customers who are not core customers, getting access. Retention of the customers elevated to power through this. |

Problem statement | There are core users who are sold on the value proposition but they still use Porter only for 30-50% of their orders. They are somehow held back due to familiarity of local contact. |

Current alternative | The users divert a decent wallet share to their local contact (unorganized sector). |

Solution | Subscription program: Pay 100 rupees to get 20 rupees off per order for 10 orders within a week. This encourages customers whose total demand is > 10 but who are giving only 5 orders to Porter. The numbers and duration can be calibrated to target the right customer set. |

Metrics to track | Success: Number of customers moving up from core to power. Leading: CTR of the subscription screen. Funnel of subscription landing page to purchase. Number of orders placed by customer. Guardrail: ROI of the discount offered through the subscription. Number of customers who are not core customers, getting access. Retention of the customers elevated to power through this. |

Ramp up milestones | 1. Build the feature 2. Scale up to 10% of customers in one city. 3. Validate the hypothesis quantitatively and qualitatively. 4. Tune the numbers. 5. Scale up city by city. |

Customer buying experience on the app

Intervention 3: Core to Power | Preferred driver partner selection

Parameter | Description |

Goal | Move Core users to Power users Core users are already largely sold on the value proposition. This gives them a nudge to move most of their orders to Porter. |

Success metric | Success: Number of customers moving up from core to power. Leading: CTR of the driver partner selection screen. Funnel of driver partner selection landing page to entering details. Number of orders placed by customer. Guardrail: % of upcoming orders which will be with the desired driver partner. Number of customers who are not core customers, getting access. Retention of the customers elevated to power through this. |

Problem statement | There are core users who are sold on the value proposition but they still use Porter only for 30-50% of their orders. They are somehow held back due to familiarity of local contact. |

Current alternative | The users divert a decent wallet share to their local contact (unorganized sector). |

Solution | Preferred driver partner selection: For every order > 5 per week, up to for 10 orders per week, increase likelihood that the next trip will be assigned to driver partner of your choice. This encourages customers whose total demand is > 10 but who are giving only 5 orders to Porter. The numbers can be calibrated to target the right customer set. |

Metrics to track | Success: Number of customers moving up from core to power. Leading: CTR of the driver partner selection screen. Funnel of driver partner selection landing page to entering details. Number of orders placed by customer. Guardrail: % of upcoming orders which will be with the desired driver partner. Number of customers who are not core customers, getting access. Retention of the customers elevated to power through this. |

Ramp up milestones | 1. Build the feature 2. Scale up to 10% of customers in one city. 3. Validate the hypothesis quantitatively and qualitatively. 4. Tune the numbers 5. Scale up city by city |

Customer experience on the app

Model

Monetization

Initiative deep dive

What is the core value prop and currency that helps users experience core value prop?

| Key elements of CVP | Porter | Major Competitor (Unorganized) |

Reliable | Vehicle is always available in-app due to thousands of driver partners in a given city | Each customer may only know 2-3 drivers who can bring goods vehicles. |

Affordable | 10-15% cheaper. Higher demand leads to higher vehicle utilization which leads to being able to offer lower price per trip since the per day earning will be higher because of higher number of trips. | Costly due to the need to pay for return trip also. There is limited set of drivers known leading to higher / willful pricing. |

Transparent | Vehicle category, price, ETA are clearly mentioned even before booking. There is automatic tracking through the app. | There is always negotiation on price. There is uncertainty on when vehicle will get free and come. There is manual tracking post pick up. |

How do the users experience the core value prop repeatedly?

Reliable: "Vehicle is always available in-app"

Every time a customer enters pickup and drop, and tries to find a vehicle, they will see that a vehicle is available within a small ETA. Further, when they order, they will get the vehicle.

Affordable: "10-15% cheaper"

Every time a customer tries to book a trip, they will see that a vehicle is available with a price that is cheaper than what they will find with the major competitor (unorganized sector). Further, when the order is completed, they realize this value when they pay the lower amount.

Transparent: "Vehicle category, price, ETA are clearly mentioned even before booking. There is automatic tracking through the app."

Every time a customer tries to book a trip, they see ETA and price clearly. What they see is what they pay once order is complete. Once they book, they will see the vehicle in the tracking screen.

Model

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore foundations by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Crack a new job or a promotion with the ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.